As we move further into 2025, just one fiscal arena stays as competitive and influential as at any time: the hedge fund NYC scene. Ny city carries on to lead the global hedge fund sector, boasting a dense focus of elite companies, groundbreaking methods, and a few of the most ambitious economical expertise on the planet. But with evolving market forces, regulatory shifts, and technological disruption, navigating this landscape requires a lot more insight than ever before prior to.

In this article’s what buyers, analysts, and finance pros have to know about the point out of hedge money in NYC these days.

Why NYC Remains the Hedge Fund Epicenter

Ny city is residence to a huge selection of hedge resources taking care of trillions in blended assets. From Midtown Manhattan places of work to remote quants operating in Brooklyn lofts, the hedge fund NYC society thrives on innovation, pace, and international market connectivity.

Town’s proximity to Wall Road, financial media, top rated educational institutions, and deep-pocketed buyers causes it to be the all-natural headquarters for a lot of the entire world’s most influential funds. Increase in a robust regulatory framework, unmatched access to cash, plus a network of strategic associates — and it’s no wonder NYC continues to be the nerve Heart from the hedge fund environment.

Dominant Tendencies Defining the Hedge Fund NYC Scene

In 2025, a number of vital tendencies are shaping the way hedge resources function in Big apple:

one. Quantitative and Algorithmic Methods

Quant resources dominate the fashionable hedge fund NYC market. Firms like Two Sigma, D.E. Shaw, and Renaissance Systems use significant-powered products to interpret extensive amounts of facts and execute trades more quickly than humanly probable. Synthetic intelligence and machine Mastering are not differentiators — they’re critical equipment.

two. ESG Integration

Environmental, Social, and Governance issues are front and Heart. Investors now desire not just returns, but sustainable general performance. NYC-based mostly hedge resources are responding by incorporating ESG metrics into their types — from carbon footprint evaluations to diversity indexes.

three. Global Macro and Geopolitical Positioning

With world-wide volatility on the rise, macro-centered hedge funds are getting ground. The big apple firms are spending close consideration to geopolitical risks in Europe, Asia, and the center East, making dynamic shifts in forex, commodity, and equity exposure as situations unfold.

4. Hybrid Buildings and Private Cash

The modern hedge fund NYC product isn’t limited to community marketplaces. Many are branching into non-public equity, undertaking capital, and personal credit. This hybrid strategy allows diversify threat and Strengthen returns although supplying money use of more time-time period, strategic performs.

Who’s Major the Pack?

Many of the most effective gamers in the hedge fund NYC entire world in 2025 include:

Millennium Management – Noted for its multi-manager design and wide diversification.

Point72 Asset Management – Leveraging equally discretionary and systematic strategies.

Third Place LLC – A long-time activist powerhouse that carries on to condition boardrooms.

Two Sigma – The poster kid for tech-fulfills-finance in the hedge fund Room.

Citadel – Nevertheless Chicago-primarily based, its NYC functions keep on being core to its world-wide dominance.

These corporations aren’t just surviving — they’re environment new criteria in performance, innovation, and agility.

Options for Buyers in 2025

For all those aiming to allocate money, the hedge fund NYC scene features each prospect and complexity. While standard fairness procedures are creating a comeback amid try these out market place volatility, lots of funds are giving custom made vehicles that align with investor aims — whether it’s alpha era, chance security, or thematic exposure.

Research stays significant. Track information, chance metrics, workforce composition, and strategy clarity are all a lot more significant than previously inside a crowded marketplace.

Essential Criteria Before Getting into the Hedge Fund NYC Marketplace

Accessibility is limited: Numerous prime-undertaking NYC hedge resources are closed to new investors or have incredibly significant minimums.

Transparency may differ: While regulatory stress has improved openness, some cash keep on being notoriously opaque.

Volatility is ordinary: Hedge funds goal for absolute returns, but limited-expression volatility remains common — especially in aggressive techniques.

Supervisor pedigree issues: The standard and regularity of the hedge fund’s leadership team frequently indicators foreseeable future results.

Remaining Thoughts

The hedge fund NYC atmosphere in 2025 is the two fiercely competitive and filled with prospective. The companies that dominate are leveraging knowledge, growing globally, taking care of hazard intelligently, and aligning with Trader expectations in ways that will happen to be unimaginable just a decade in the past.

No matter whether you’re an institutional Trader trying to find alpha, a money Experienced navigating your future vocation move, or an outsider looking in, comprehending the terrain from the NYC hedge fund scene is a must. This is where monetary innovation is born — and exactly where fortunes are made

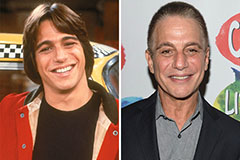

Tony Danza Then & Now!

Tony Danza Then & Now! Val Kilmer Then & Now!

Val Kilmer Then & Now! Keshia Knight Pulliam Then & Now!

Keshia Knight Pulliam Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now! Dolly Parton Then & Now!

Dolly Parton Then & Now!